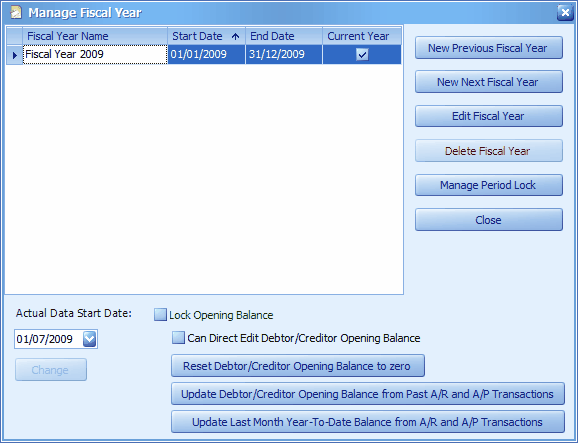

This menu is used to manage fiscal years and its related functions.

In AutoCount Accounting, Year End Closing is not mandatory. Thus users have the flexibility of accessing to preceding or subsequent fiscal years easily.

Fiscal Year Name: the system will automatically name it as 'Fiscal Year <yyyy>' according to the year of End Date; however, you may change the name by click on Edit Fiscal Year

Start Date: the start date of fiscal year must be on the first day of any month.

End Date: the end date of fiscal year must be on the last day of any month

Current Year: Current Year is determined during creation of account book. Current account year moves forward after Year End Closing. The check sign of current year also points out the year which the current opening balances refer to.

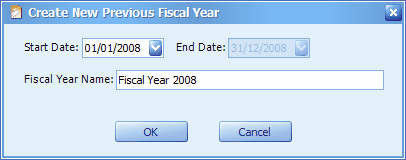

New Previous Fiscal Year: click to highlight fiscal year on the top row and click on this button to create a new previous fiscal year. This is necessary if you need to view reports related to previous years.

All value are automatically filled, you may change the Start Date, but the 'End Date' is not allowed to change (because it relates to Start Date of the subsequent year).

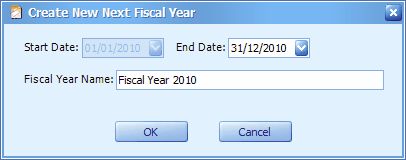

New Next Fiscal Year: click to highlight fiscal year at the most bottom and click on this button to create a new next fiscal year. This is necessary if you need to proceed with transactions without doing Year End Closing on current fiscal year.

All value are automatically filled, you may change the End Date, but the 'Start Date' is not allowed to change (because it relates to End Date of the preceding year).

Edit Fiscal Year: this is to edit the start/end date and fiscal year name. You may edit both Start Date and End Date when there is only one fiscal year and it has no transaction. You may only edit the Start Date of a fiscal year when it has no previous fiscal year before it. You may only edit the End Date of a fiscal year when it has no next fiscal year after it.

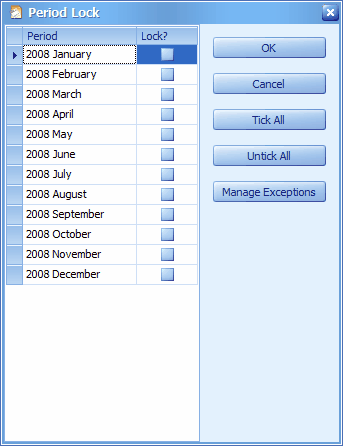

Manage Period Lock: allows you to lock the periods (months) of a fiscal year to prevent further amendment.

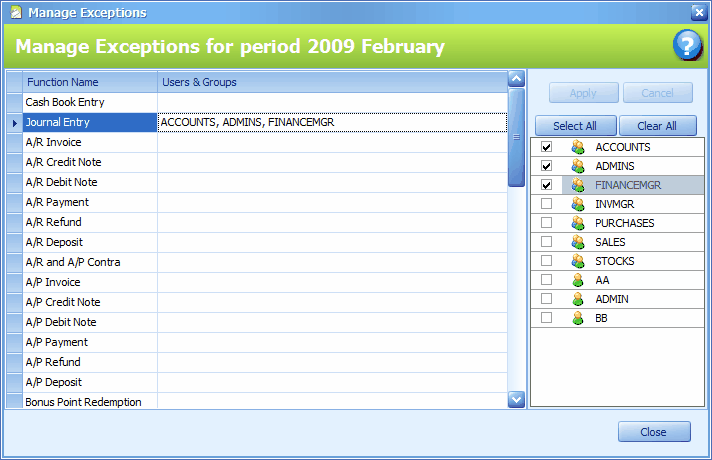

Manage Exception: highlight a locked period, and click on this button to set access rights or exception to locked menus for specific users/groups.

Lock Opening Balance: to lock the opening balance from further amendment. When this is checked, the following 3 functions will be disabled:

Can Direct Edit Debtor/Creditor Opening Balance

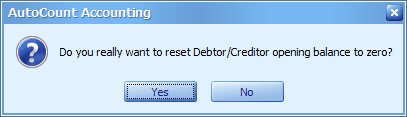

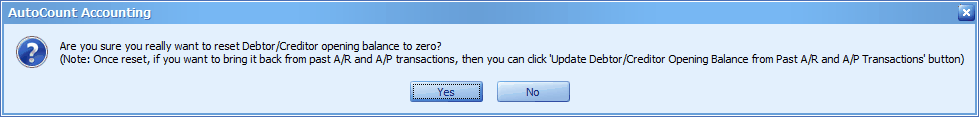

Reset Debtor/Creditor Opening Balance to Zero

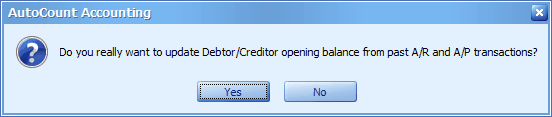

Update Debtor/Creditor Opening Balance from Past A/R and A/P Transactions

Can Direct Edit Debtor/Creditor Opening Balance: to allow direct key in the opening balance for debtor/creditor. This is usually used on non open-item debtors/creditors.

Reset Debtor/Creditor Opening Balance to Zero: to reset the value of opening balance of debtors/creditors to zero.

Update Debtor/Creditor Opening Balance from Past A/R and A/P Transactions: after keyed in Past A/R or A/P documents, the opening balance will be updated; run this if it is not.

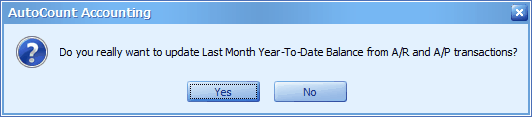

Update Last Month Year-To-Date Balance from A/R and A/P Transactions: the system will calculate from related A/R and A/P transactions and update to the last month of Year To Date Balance Maintenance. This feature is used only when the Actual Data Start Date is later than current Fiscal Year Start Date, and the checkbox of Balance B/F in the last month of Year-To-Date Balance in Tools > Options > General > Application Settings is checked.

Note: only the debtor/creditor account will be updated.

Actual Data Start Date: to define the first day of the month which the system is actually used for transaction. Pay attention to the situation when Actual Data Start Date is different from Current Fiscal Year Start Date, and decide how would you like to deal with the opening balance. Refer to FAQ topic: How To Enter Opening Balance for more detail.

_____________________________________________________________

Send feedback about this topic to AutoCount. peter@autocountSoft.com

© 2013 Auto Count Sdn Bhd - Peter Tan. All rights reserved.