In AutoCount Accounting system, Landing Cost module is mainly used to distribute the related landing cost (such as Freight, Forwarding, Insurance charges) and add onto cost of purchase among items purchased, so that the stock costing will be correctly updated. Landing cost will increase the closing stock value, thus affecting gross profit in Profit & Loss Statement.

Example:

(Invoice 1) A Purchase Invoice consists of 2 items: Item A (400.00) and Item B (600.00)

(Invoice 2) Another Invoice received from Forwarding company showing landing cost of 100.00

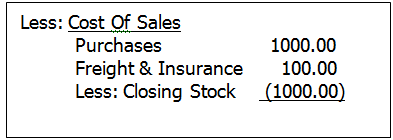

If Landing Cost module is not used: the landing cost of 100.00 will not be added onto the stock costing... thus Closing Stock will be 1000.00.... Invoice 2 will be recorded and posted to Freight & Insurance account (Cost of Goods Sold).

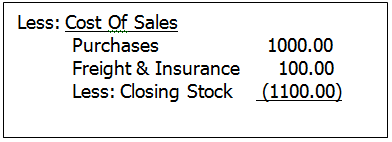

If Landing Cost module is used: the landing cost of 100.00 will be added onto the stock costing... thus Closing Stock will be 1100.00.... Invoice 2 will be recorded and posted to Freight & Insurance account (Cost of Goods Sold).

Of course in this case, average cost of Item A and B will be affected as well.

_____________________________________________________________

Send feedback about this topic to AutoCount. peter@autocountSoft.com

© 2013 Auto Count Sdn Bhd - Peter Tan. All rights reserved.