(From version 1.3.5.06 onwards.)

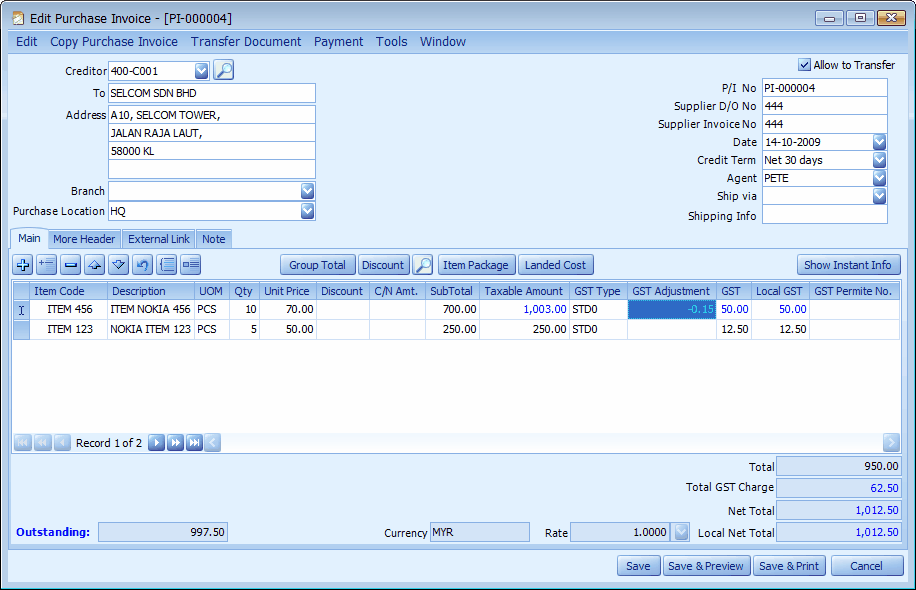

Taxable Amount column, GST Adjustment column ....

Available in all Purchase documents, the columns of Taxable Amount and GST Adjustment

GST column and Local GST column: the values of these columns will be determined by Taxable Amount and GST Type... these value can be adjusted using GST Adjustment column.

Taxable Amount column: the value will capture from Subtotal column (amendable).... this is also available in AR/AP module in earlier version.

GST Adjustment column: to adjust the value of GST and Local GST columns e.g. for several cents.

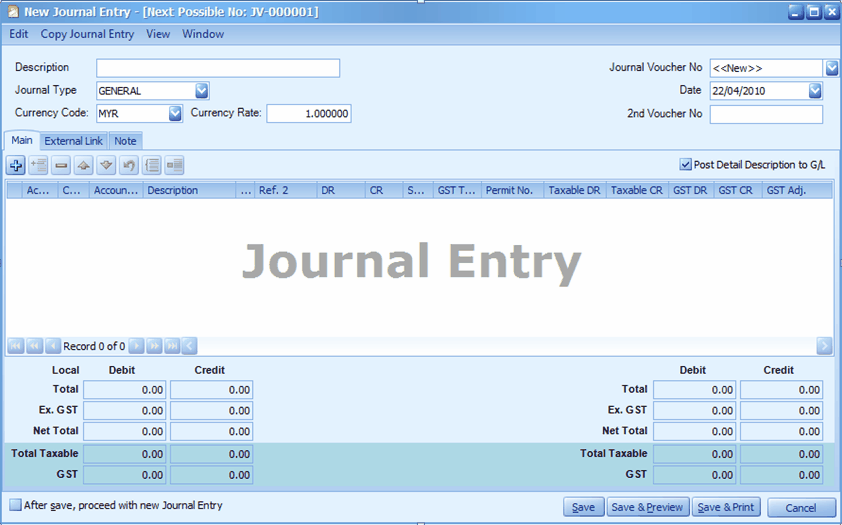

Fully support TaxableAmt, TaxAdjustment, and Tax in Journal Entry.

The TaxableAmt and Tax logic is enhanced in Journal Entry, the new Journal Entry screen now looks like below:

(The calculation of Tax is same as in other documents such as Cash Book Entry, Sales document and Purchase documents.)

_____________________________________________________________

Send feedback about this topic to AutoCount. peter@autocountSoft.com

© 2013 Auto Count Sdn Bhd - Peter Tan. All rights reserved.