Though AutoCount Accounting allows you to key in opening balances of debtors/creditors directly without maintaining any transaction entries, it is advisable not to key in opening balances of personal account (debtor/creditor) directly, instead, add 'Past' entries or 'YTD' entries at AR/AP menu and have debtor/creditor opening balances or YTD balances updated automatically.

* to allow key in opening balance directly for debtors/creditors, go to Tools > Manage Fiscal Year, highlight current fiscal year, check the checkbox of

![]() .

.

It is not advisable to key in debtor/creditor opening balance in this way because it keeps no record of entries, thus will not be shown in debtor statement and knock off payment is not available.

* go to AR/AP menu to key in 'Past' entries or 'YTD' entries such as Invoice, CN, DN, Payment.... If you do not wish to key in all the outstanding bills one by one, you may just add one Past or YTD invoice with the total (one lump sum) outstanding balance. The amounts of Past/YTD entries will be updated to Opening/YTD Balance; if not, go to Tools > Manage Fiscal Year, highlight the current fiscal year, click on

![]() or

or ![]() .

.

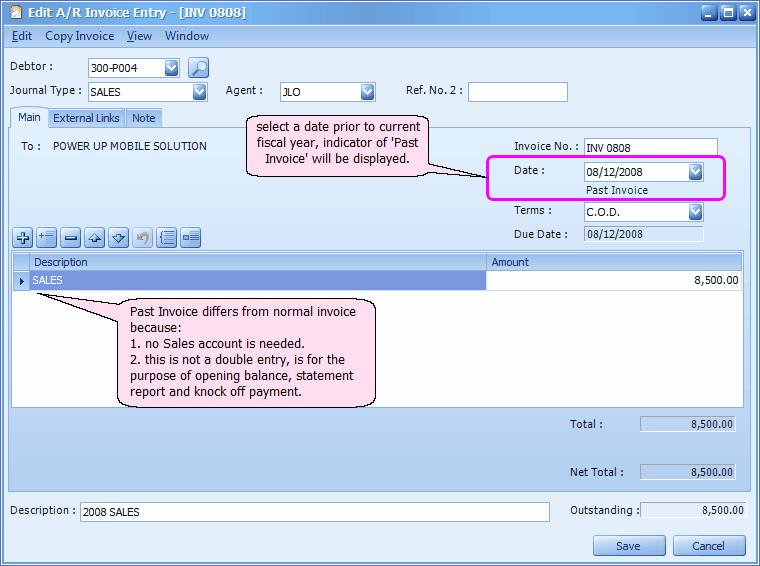

Past Entries

Past entries means A/R or A/P entries (usually Invoice, but also including Payment, DN, CN...) that is created with a date prior to current fiscal year.

For example: A/R Invoice

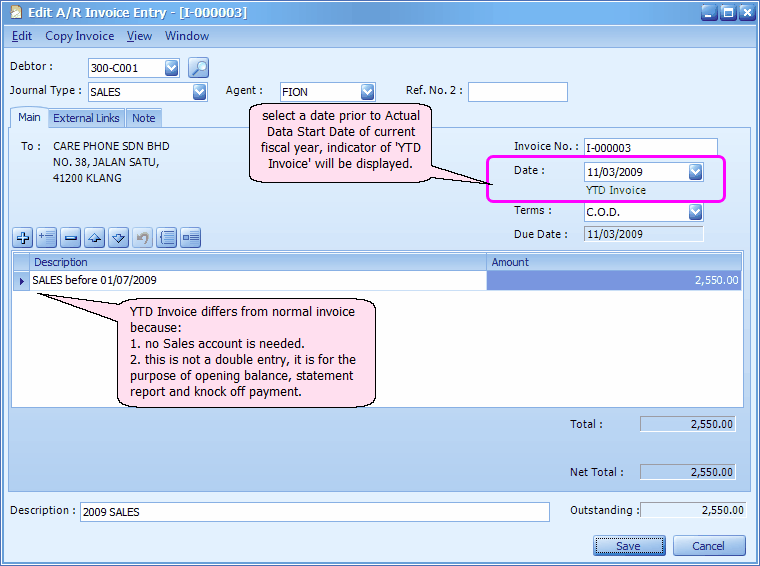

YTD Entries

YTD (Year-To-Date) entries means A/R or A/P entries (usually Invoice, but also including Payment, DN, CN...) that is created with a date on/after Start Date of current fiscal year but prior to Actual Data Start Date.

For example: A/R Invoice

_____________________________________________________________

Send feedback about this topic to AutoCount. peter@autocountSoft.com

© 2010 Auto Count Sdn Bhd - Peter Tan. All rights reserved.