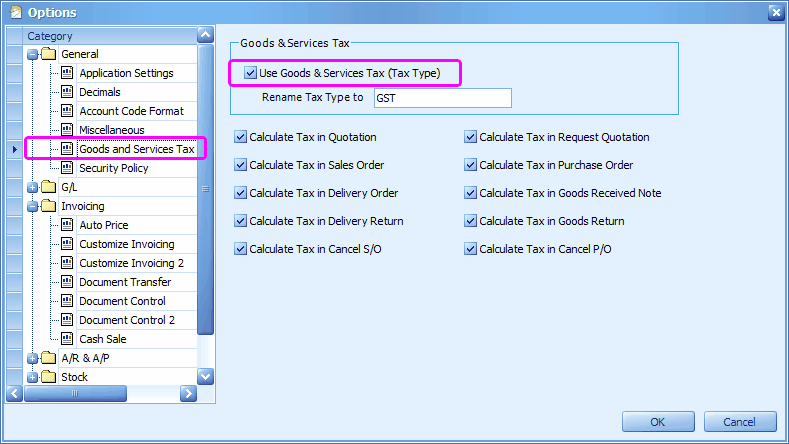

Enable Tax Option

Go to Tools > Options > General > Goods and Services Tax, check the checkbox of Use Goods & Services Tax (Tax Type)

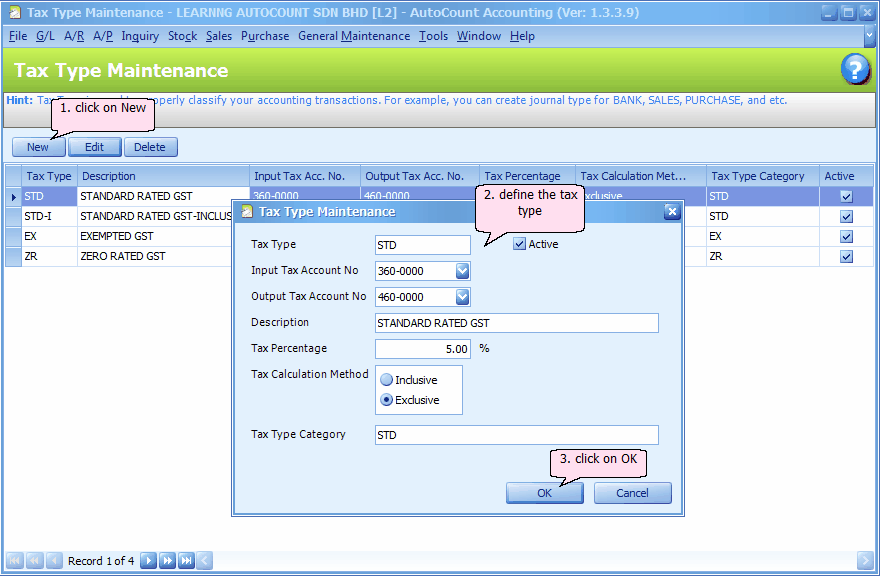

Maintain Tax Type

Go to General Maintenance> Tax Type Maintenance

Tax Type: give the tax type a code name

Active: Active means this tax type is enabled and in-use

Input Tax Account No: assign the Input (Purchase) Tax account for posting purpose. You need to maintain this account (Current Liability type) at G/L > Account Maintenance.

Output Tax Account No: assign the Output (Sales) Tax account for posting purpose. You need to maintain this account (Current Asset type) at G/L > Account Maintenance.

Description: key in the description of this tax type

Tax Percentage: define the tax percentage

Tax Calculation Method: choose either Inclusive or Exclusive. Inclusive means the tax is included in sales/purchase price, which means actual sales/purchase value will be = Sales or Purchase Price / (1+ r) .... where r is the tax rate.

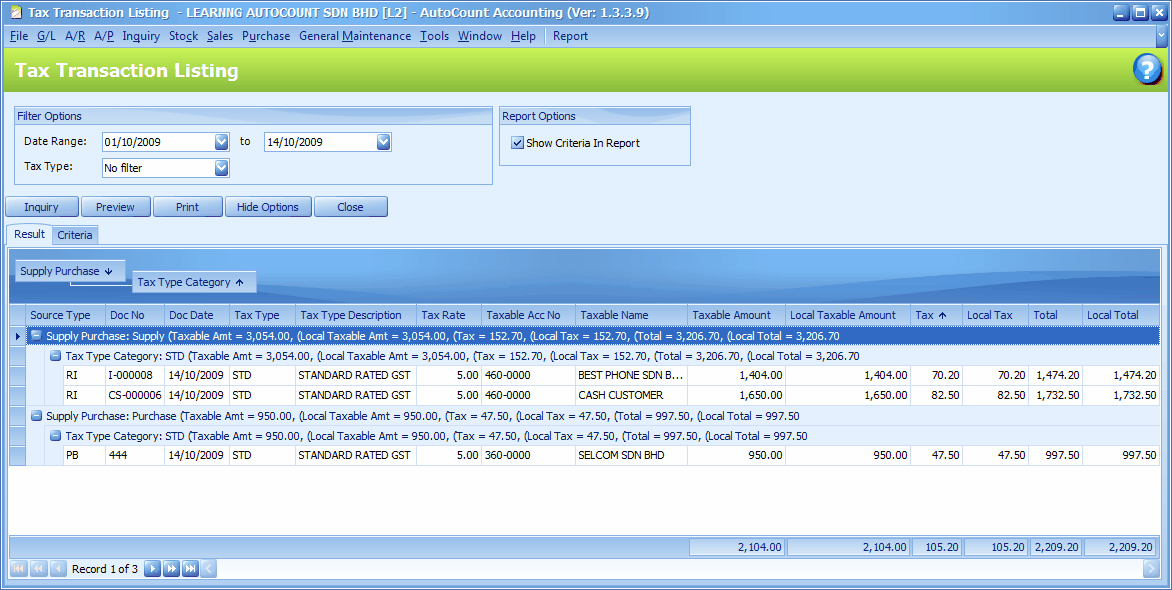

Tax Type Category: key in the tax type category for reporting purpose (Tax Transaction Listing Report)

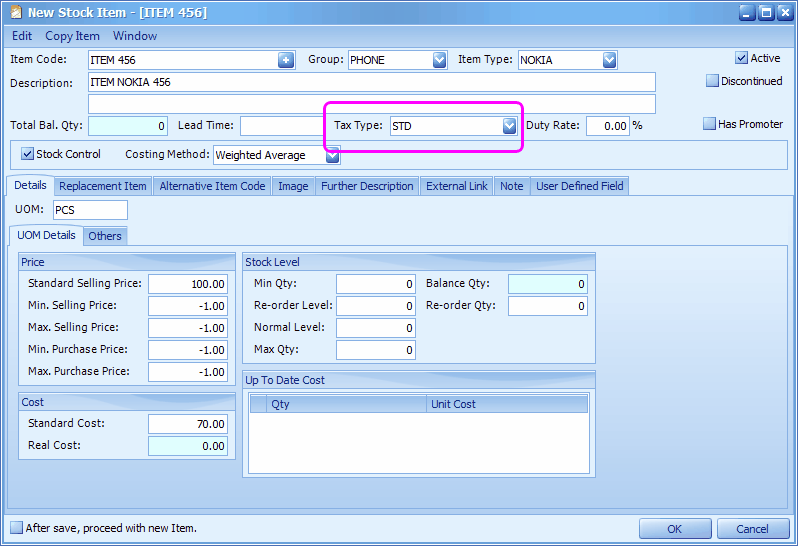

Assign Tax Type To Item

Go to Stock > Stock Item Maintenance and assign tax type to stock items.

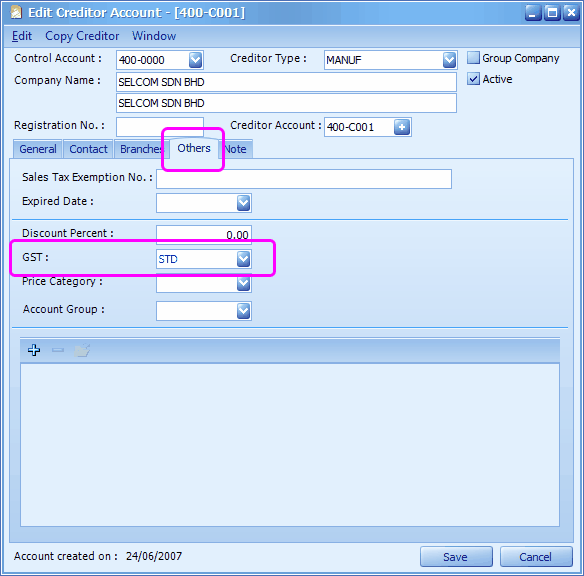

Assign Tax Type To Creditor/Debtor

You may go to A/P > Creditor Maintenance and assign tax type to creditors.

You may go to A/R > Debtor Maintenance and assign tax type to debtors.

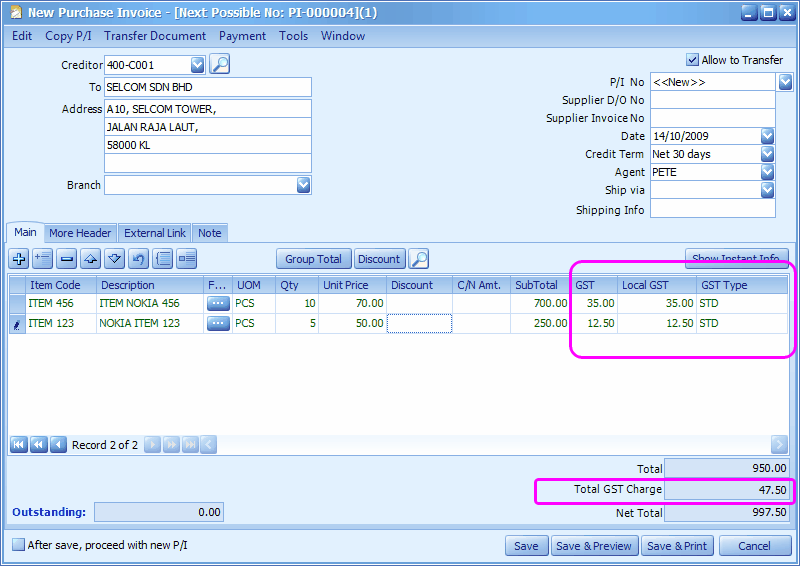

Purchase Document

Purchase > Purchase Invoice

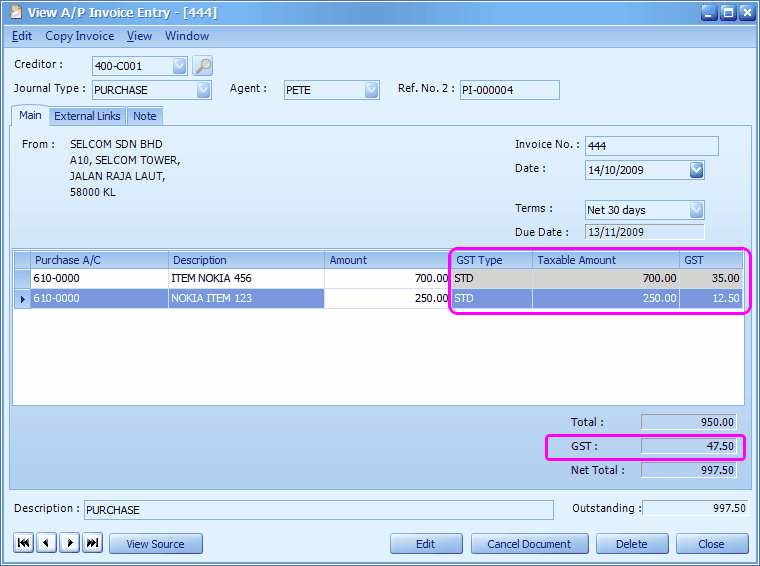

Take a look at A/P > A/P Invoice Entry

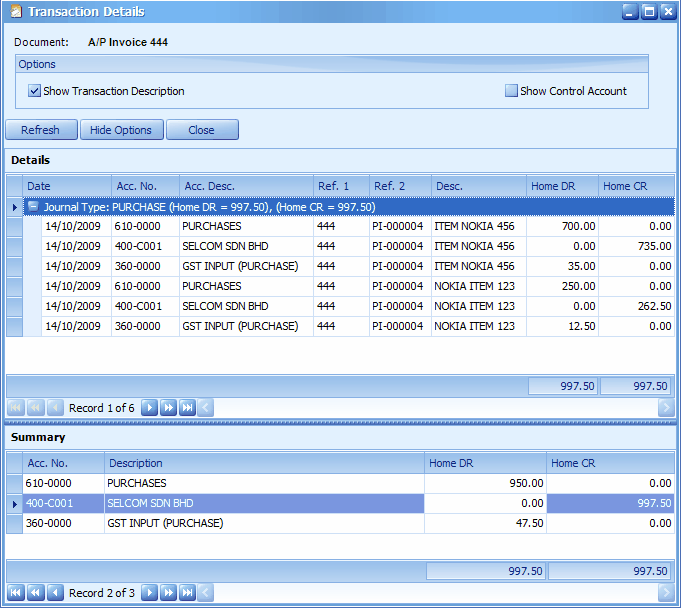

At A/P Invoice Entry screen, click on View > View Posting Details,

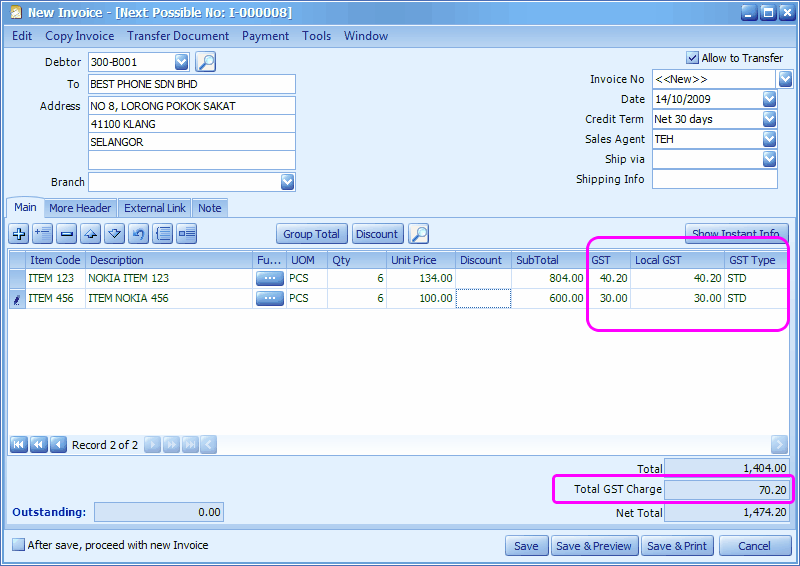

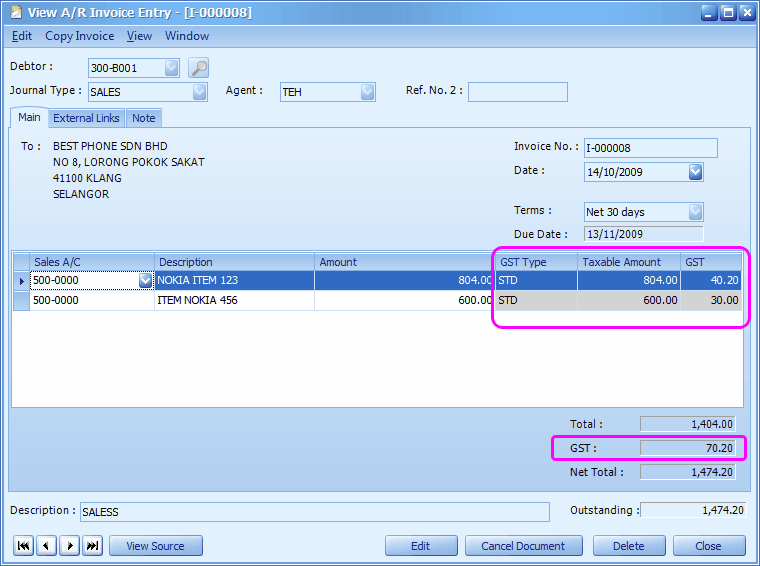

Sales Document

Sales > Invoice

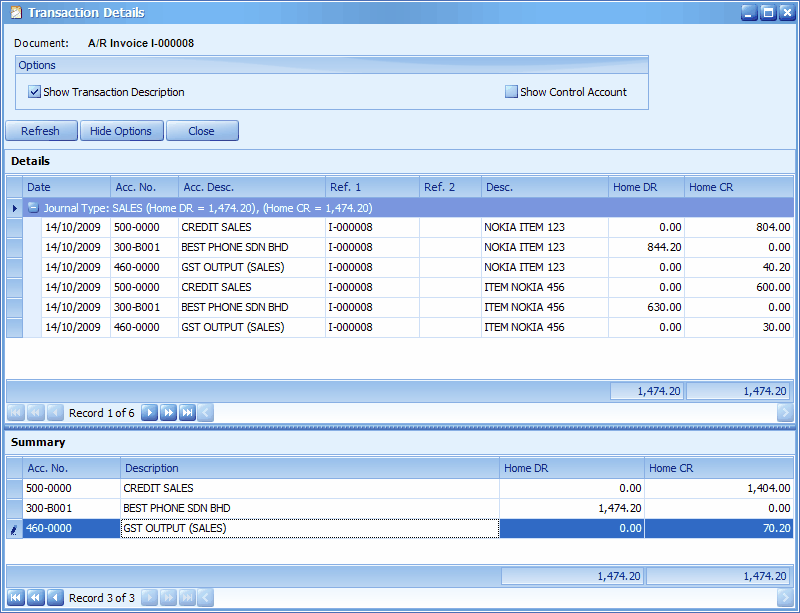

Take a look at A/R > A/R Invoice Entry

At A/R Invoice Entry screen, click on View > View Posting Details,

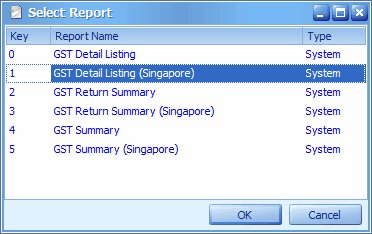

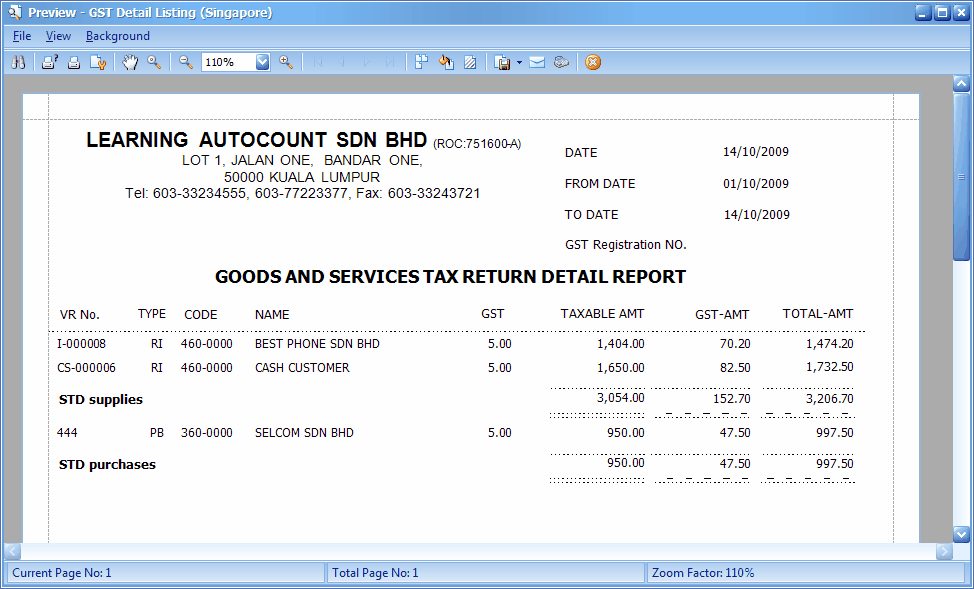

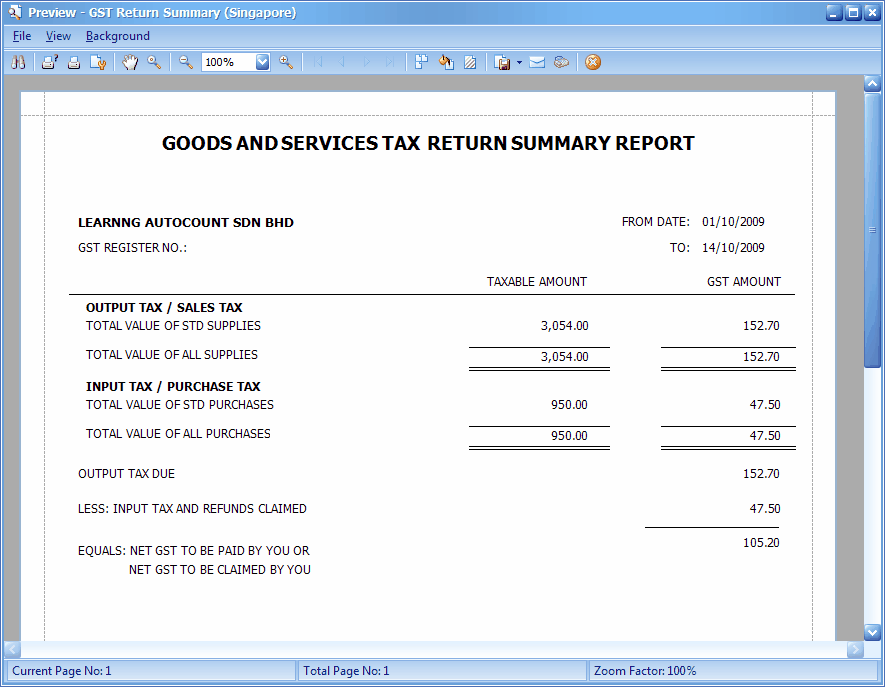

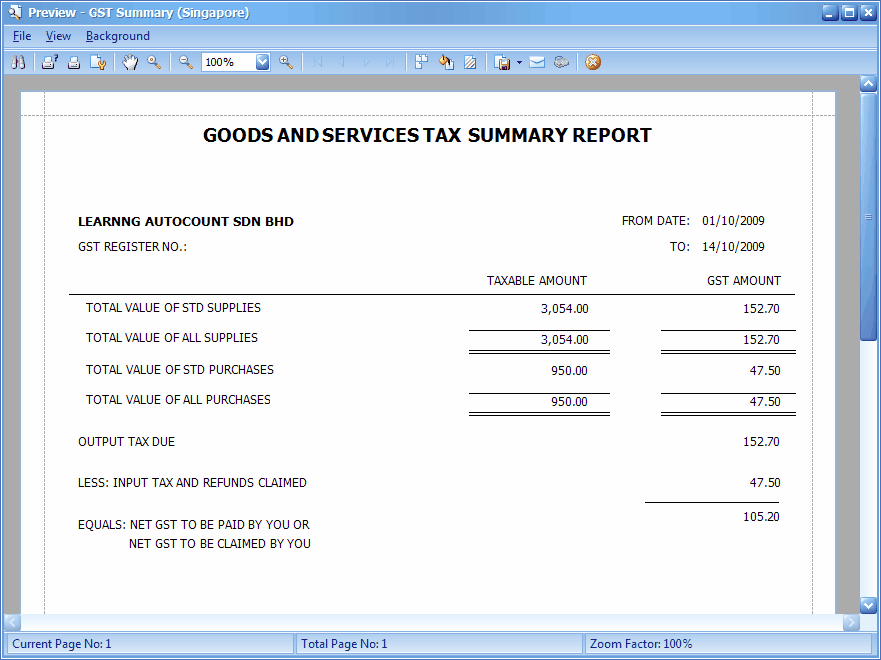

Tax Transaction Listing Report

Also refer to:

_____________________________________________________________

Send feedback about this topic to AutoCount. peter@autocountSoft.com

© 2010 Auto Count Sdn Bhd - Peter Tan. All rights reserved.